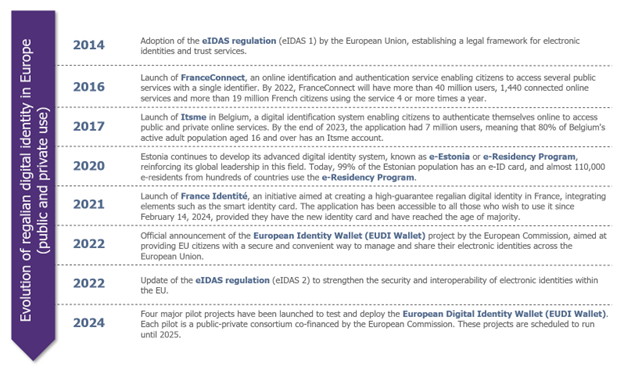

The need for a regal digital identity stems from the need to guarantee the reliability of online exchanges and transactions, in the face of rising fraud in a context of increasing dematerialization. The European Union responded by introducing the eIDAS regulation in 2014, aimed at promoting the interoperability of electronic identification and authentication systems within the EU.

Regal digital identity brings together all the information essential to formally authenticate an individual or organization in the digital world. This includes personal identification data, electronic certificates and biometric information. This identity is crucial for securing electronic transactions, facilitating access to online public services and protecting citizens’ rights and privacy.

In France, a program was launched in 2018 to create a high-guarantee digital regal identity. At the same time, France is committed to the introduction of a smart ID card with a chip, which will form the basis of this electronic identification. This authentication mode will be integrated into FranceConnect+ created at the end of 2021, an online identification and authentication service of minimum substantial level.

Examples of use cases depending on the target :

Companies

A potential B2E use case could be re-registration and access recovery. The use of regalian digital identity becomes particularly relevant in companies where employee authentication relies exclusively on FIDO passkeys linked to a device, often their phone. If this device is lost, the employee is unable to authenticate. With regalian digital identity, access recovery is simplified. Employees can use their digital identity to restore their access, then get a new phone and re-enroll their FIDO passkeys. In this way, the re-registration and access recovery process is greatly facilitated, guaranteeing enhanced service continuity.

On the CIAM side, banks could use regalian digital identity to verify the identity of customers when opening online accounts or carrying out sensitive transactions, and thus improve the security level of their service and their KYC (know Your Client) process. Currently in France, customers can use FranceConnect to authenticate themselves with banks such as BNP Paribas when opening online accounts, guaranteeing secure and simplified identity verification. Similarly, e-commerce sites could use the regalian digital identity to enable users to authenticate themselves securely when purchasing products, further enhancing security and reducing the risk of fraud.

In the context of the extended enterprise (a form of organization enabling collaboration between a company, its subsidiaries and its partners), the secure enrolment of partners to access the company’s information systems (IS) is crucial. The challenge is to increase the level of confidence in enrolment, while at the same time making it easier.

The use of the European Identity Wallet or other identity wallet could significantly simplify and secure this process. Partner employees could prove their identity to the company they wish to collaborate with, using their identity wallet. Here’s how it could work:

First of all, for the initial registration employees of partner organizations use their identity wallets to register with the main company’s system. Identity is then verified using electronic certificates and other secure information.

Once registration has been validated, these employees can access the main company’s information systems. The identity wallet enables secure authentication in line with corporate security standards. Or secure enrolment in the company’s local authentication systems.

The identity wallet can also be used to manage and modulate access rights according to the specific roles and needs of partner employees, reducing the risk of over-provisioning and increasing security.

If identity information changes (for example, if an employee changes position or responsibility), access can be updated seamlessly via the identity portfolio, without the need for cumbersome administrative processes.

Imagine a construction company working with various subcontractors on different projects. Subcontractors’ employees can use their identity portfolio to authenticate themselves and access project plans and documents hosted on the main company’s IS. This ensures that only authorized and verified employees have access to sensitive information, and that their access can be quickly modified or revoked if necessary.

Citizens

Regalian digital identities offer citizens numerous advantages, notably by simplifying access to various online services and reinforcing the security of digital transactions. In France, for example, insured persons can use their digital identity via the Ameli service to access their personal space. This enables them to consult their reimbursements, book appointments with healthcare professionals and manage other aspects of their medical cover securely online.

Similarly, for tax purposes, French citizens can use their régalienne digital identity via impots.gouv.fr. This feature facilitates online tax declarations, enabling users to fill in their returns, consult their tax notices and track their payments and refunds simply and securely.

Beyond France, other European countries are also implementing digital identity solutions to improve access to public services. Students, for example, will benefit greatly from the regalian digital identity for their administrative procedures. They will be able to use it to enroll in universities, access their transcripts, and manage their student accounts in a secure and simplified way. What’s more, international students will also be able to use this identity to validate their residency status and access various public and academic services without the hassle of paper procedures.

In Spain, regalian digital identity enables citizens to electronically sign official documents via the FirmaDigital.gob.es service. This solution is used for tasks such as signing rental contracts, submitting administrative documents, and other procedures requiring a legal signature. This makes administrative processes more efficient and secure, eliminating the need for physical signatures and reducing the risk of fraud.

The European Identity Wallet (EUDI)

The European Identity Wallet (EUDI Wallet) is a major initiative by the European Commission to provide EU citizens with a secure, interoperable way of managing their digital identity across borders. Designed to offer a convenient and secure solution, EUDI Wallet will enable citizens to store and share their electronic credentials seamlessly, while preserving their privacy and complying with the EU’s strict data protection standards.

This concept emerges against the backdrop of the increasing digitization of European society and the need to reinforce trust in online transactions. With the diversity of electronic identification systems used across the EU, EUDI Wallet aims to harmonize these systems and facilitate access to cross-border digital services, such as public services, commercial transactions and online interactions with businesses.

The EUDI Wallet will therefore function as a secure digital wallet where citizens can store their identification information such as electronic certificates, biometric data and identity documents. They will be able to use this wallet to authenticate themselves online and access a range of digital services across the European Union.

With the EUDI Wallet, citizens will be able to easily access their healthcare data, such as patient summaries and electronic prescriptions, anywhere in the EU, promoting better continuity of care. In addition, Wallet will enable diplomas and professional qualifications to be securely managed and verified, simplifying the recognition of qualifications and promoting worker mobility. Finally, it will facilitate online transactions by ensuring strong, harmonized authentication, thereby boosting confidence in cross-border e-commerce.

In order to carry out these use cases, the European Commission has defined two main scenarios describing very basically the portfolio’s use flows;

To date, the countries of the European Union have agreed on the content to be included in the European wallet, and have agreed on a global standard for the project, with a target implementation date of 2026. What remains to be done is to finalize the standard, draw up precise technical specifications for it, and develop the technical solutions to be implemented in each European country to ensure compatibility with the established standard.

Conclusion

The introduction of the European Identity Wallet (EUDI Wallet) represents a crucial step towards a more integrated and digitized digital Europe, offering numerous benefits to citizens and businesses across the European Union. In France, the adoption of EUDI Wallet will depend on several key factors. Firstly, the establishment of a robust regulatory framework that complies with data protection standards such as the RGPD will be essential to ensure user confidence and the security of their personal data. In addition, public confidence in the security and reliability of EUDI Wallet will play a decisive role in its widespread adoption. Public awareness and education campaigns on the benefits and security measures of EUDI Wallet could help build this confidence.

However, the most important element for EUDI Wallet will be the rate of adoption by private services. The involvement of private companies is crucial, as they provide a large proportion of the services used daily by citizens. Widespread adoption by the banking, healthcare, education and other private services sectors would ensure wider and regular use of the wallet, making its integration more fluid and natural for users.

The technology is still emerging and not yet mature enough to be implemented immediately. However, given the many potential benefits, it is crucial to follow this technology closely and adopt it as soon as possible. This is particularly true for the banking sector and extended enterprise use cases, where EUDI Wallet could bring significant improvements in security, transaction fluidity and operational efficiency.

Nevertheless, by overcoming these obstacles and taking advantage of the opportunities offered by EUDI Wallet, France could play a leading role in building a more secure, innovative and connected digital Europe for years to come.